Chatbots bring innovation to insurance

Chatbots are providing innovation and real added value for the insurance industry. They are popular both as customer-facing chatbots, which can provide quotes and immediate cover, 24/7, and internally, to help insurance companies process new claims. For the customer, the insurance chatbot is a welcome development, one that extends office hours around the clock and one that is capable of finding the right product and the right quote in an instant. Without the customer having to pick up the phone. In fact, the insurer’s chatbot can be contacted via the customer’s favourite messaging channel.

For insurers, chatbots that integrate with backend systems for creating claim tickets and advancing the process of managing claims, are a cheaper and more easy-to-use solution for staff than a bespoke software build. Such chatbots can be launched on Slack or the company’s own internal communication systems, or even just operate via email exchanges.

Empowering Policyholders

The standard for a new era in customer service is being set across the board, and the insurance industry is not exempt. Sectors like digital technology and retail brands are on the front lines of new methods and advancing tech, and as consumers grow accustomed to fast, personal service, expectations mount in other industries.

Today’s consumers expect similar levels of service from their insurance providers as they do elsewhere; they want to be able to engage with an enterprise on the channel of their choosing, much like they would with any individual. With an innovative approach to customer service that builds a relationship between provider and policyholder, insurance companies can empower their consumers in a way that inspires not only loyalty but also advocacy.

Download BrochureConversational Coverage

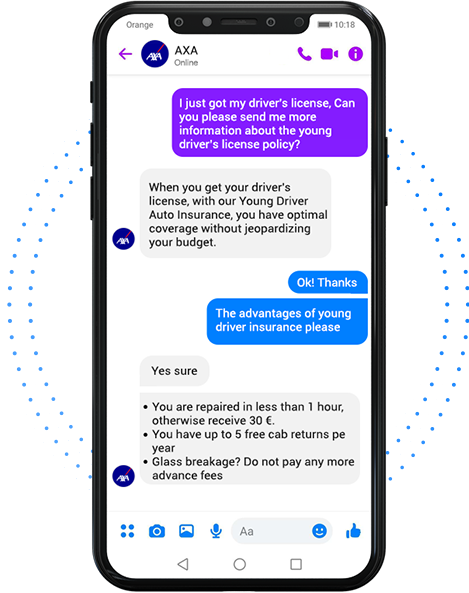

Traditional means of customer outreach like websites and apps speak “computer language,” requiring users to navigate menus and screens and input information via commands and clicks.

Chatbots, however, speak the human language through machine learning and natural language processing that draws context from exchange to answer questions and accomplish tasks, all in a natural, conversational manner. This approach, when applied to the insurance industry, is known as “conversational coverage,” and it’s a tested and true method to meet the desires of the modern consumer: personalization, engagement, and self-service.

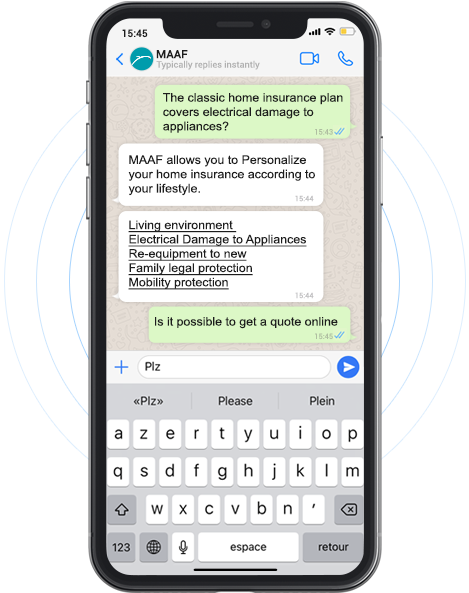

Your Choice of Channel

Multi-channel integration is a pivotal aspect of a solid digital strategy. By employing bots to multiple channels, consumers can converse with their provider via a number of means, whether it’s a messaging app like Slack or Skype, email, SMS, or a website.

Being channel-agnostic allows bots to be where the customers want to be and gives them the choice in how they communicate, regardless of location or device. This type of added value fosters trusting relationships, which retains customers, and is proven to create brand advocates.

The Power of Bots in Insurance

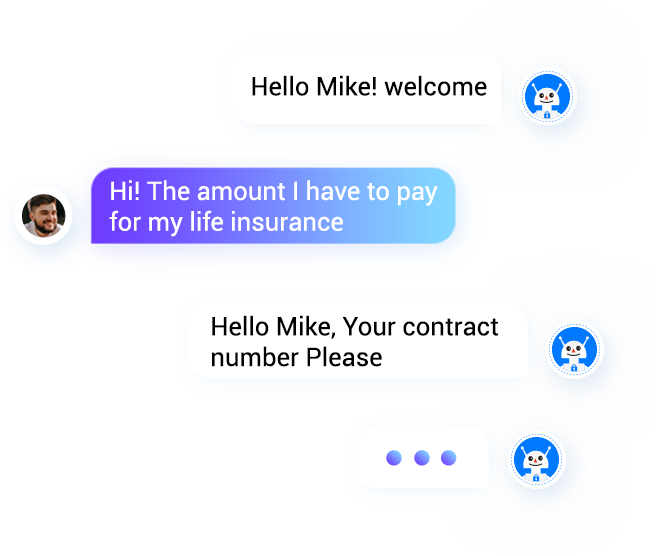

By offering policyholders an improved experience with a self-service option that provides information and resolves issues in real-time, bots are changing the customer service arena in many industries. Here are just a few ways in which bots are able to improve the insurance sector:

- Manage claims quickly and efficiently

- Deliver personalized quotes

- Simplify ordinary tasks like account updates and payments

- Offer relevant coverage and care advice

- Solidify long-term relationships between provider and policyholder

By bringing each citizen into focus and supplying them a voice—one that will be heard—governments can expect to see (and in some cases, already see) a stronger bond between leadership and citizens. Visit SnatchBot today to discover how you can build and deploy bots across multiple channels in minutes.