Bots: The Future of Financial Services

Whether your focus is retail, commercial, or investment banking, insurance, or fintech, bots can provide a conversational and engaging experience for your customers. Employing bots will alter the way in which traditional transactions are handled.

Digitizing Customer Service

Bots are revolutionizing digital customer service strategies by being a valuable resource in that they can offer sustainable service around the clock. Early adopters of bot technology have already seen higher customer engagement, cultivation of loyalty, and increased sales.

Download BrochureWhat do modern consumers want?

The traditional “one-size-fits-all” approach to consumer relations is outdated and fails to meet the expectations of modern customers, who want a personalized approach. Many financial service providers are still missing significant opportunities to fulfill their customers’ needs.

Transform your digital consumer service strategy

The advent of digital channels has brought about a significant change in many industries, particularly the financial sector. These days, consumers are driving the way the interactions are handled, and they expect the financial institutions to revolutionize their approach with:

Using bots in financial services

Whether your focus is retail, insurance, FinTech, or banking, bots are an easy and inexpensive way to sustain profitability and win over customers:

Provide support and resolution efficiently across channels (voice calls, text, email, messaging apps, website, etc.).

Offer real-time financial services/data at the engagement point.

Supply twenty-four-hour self-service.

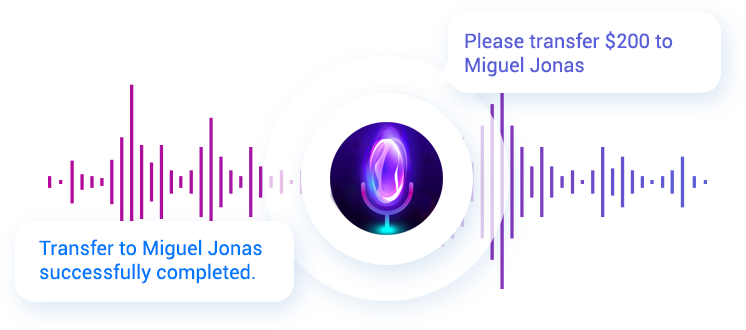

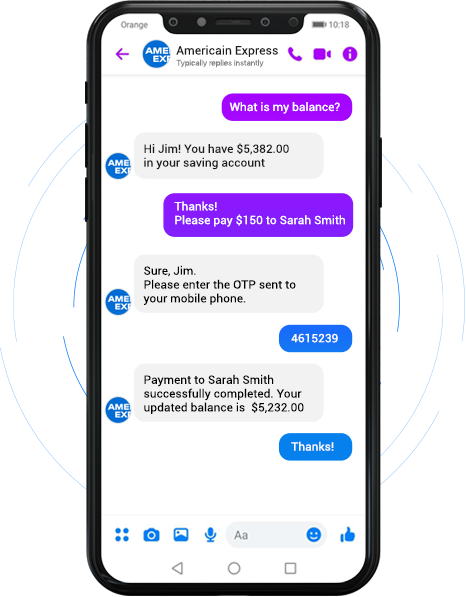

Transform ordinary transactions, policy updates, payments, fraud remediation, and more into simple text or voice exchanges.

Practical examples of how Bots can help

B2C and B2E

Retail banking

- User and Account registration

- Dual factor authentication

- Branch and ATM locator

- Spending analysis

- Apply for new services and request checkbook, call back

- Report lost or stolen card

Wealth and Asset Management

- Intelligent Risk Assessment questions

- Portfolio rebalancing suggestion

- Portfolio performance analysis

- Mutual fund and equity transactions

Markets and Exchanges

- Currency rates data and rate alerts

- Real-time financial market data

Fintech: Payments and Transfers

- Client onboarding

- Transfer money to own account

- Transfer money to third party

- Bill payment

- Add/modify/delete payee

- P2P and Recurring payment

- Currency rates data and rate alerts

- Real-time financial market data

Lending and Financing

- Mortgage offering that fit your profile

- Monthly loan statement and more

Blockchain Transactions

- Bitcoin

- Ethereum

TRY OUR CHATBOT TEMPLATES BELOW AND START BUILDING YOUR OWN

Turn Banking Tasks Into Simple Experiences

In short, bots can turn banking tasks into simple experiences that not only satisfy the customer’s needs, but do so in a way that is engaging and conversational.

Bots are being employed internally as well (B2E Business to Employee), to assist enterprises in tasks that traditionally waste time and manpower. Bots can deliver detailed information on-demand; retrieve, modify, and post data in systems of record; check systems for updates and provide details upon delivery, and create workflows by using alerts to automatically populate input fields.

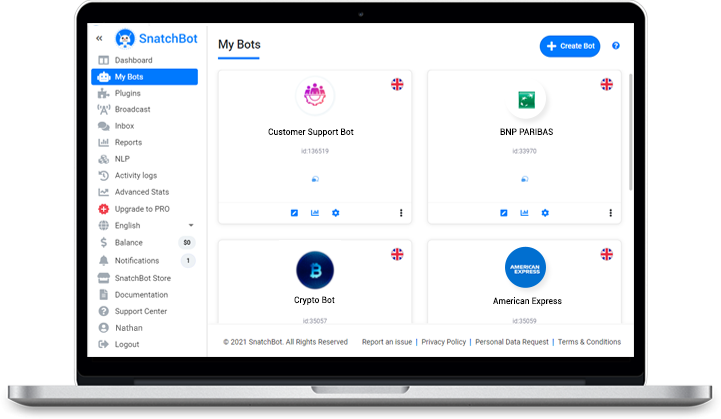

Many financial institutions are raising the bar with bots by allowing financial service providers the opportunity to regain previously abandoned customers and bring the enterprise/consumer relationship into full focus. If your enterprise isn’t enhancing its digital strategy with bots, the SnatchBot platform can help you build and deploy bots across multiple channels.